2022 Market Overview Report

2022 has been another roller-coaster year for the crypto market. Of course, the biggest event of the month has been the arrest of FTX founder Sam Bankman-Fried. However, before we get into the granular details, let’s look at the DeFi and NFT markets.

The DeFi market plunged in December, as the total value locked (TVL) in these protocols fell from $42.56 billion to $39.37 billion. That’s almost $3 billion eradicated from these markets.

As of now, the top 5 DeFi apps in the world are – MakerDAO, Lido, AAVE, Curve, and Uniswap. Both MakerDAO and Lido have TVL over $5 billion.

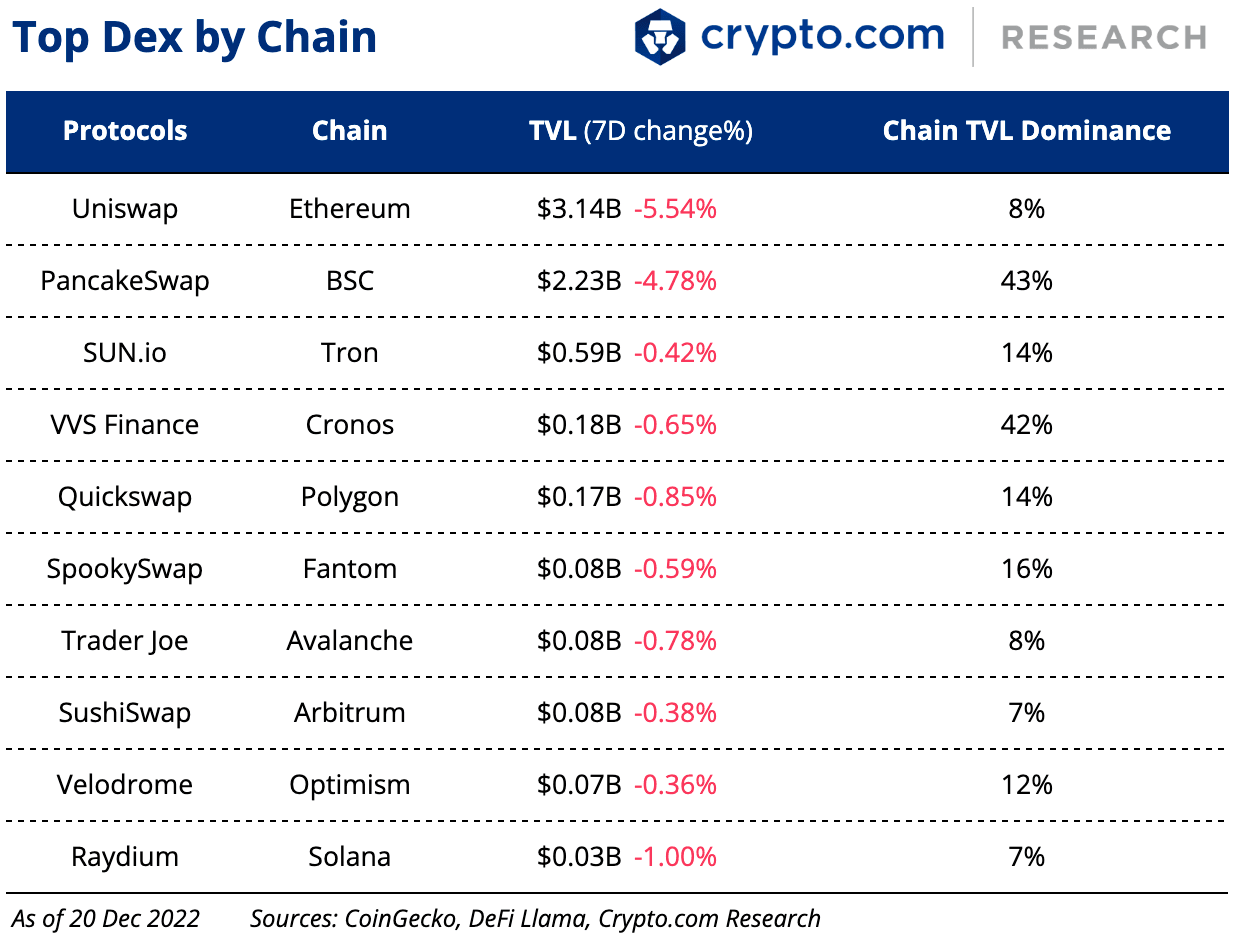

Here are some more DeFi stats taken from crypto.com.

As you can see, Ethereum remains the most popular chain for DeFi protocols, with Binance and Tron finishing up the top 3.

Uniswap and PancakeSwap remain the most popular Dexes by far.

DeFi Alpha

Stablecoin resurrection

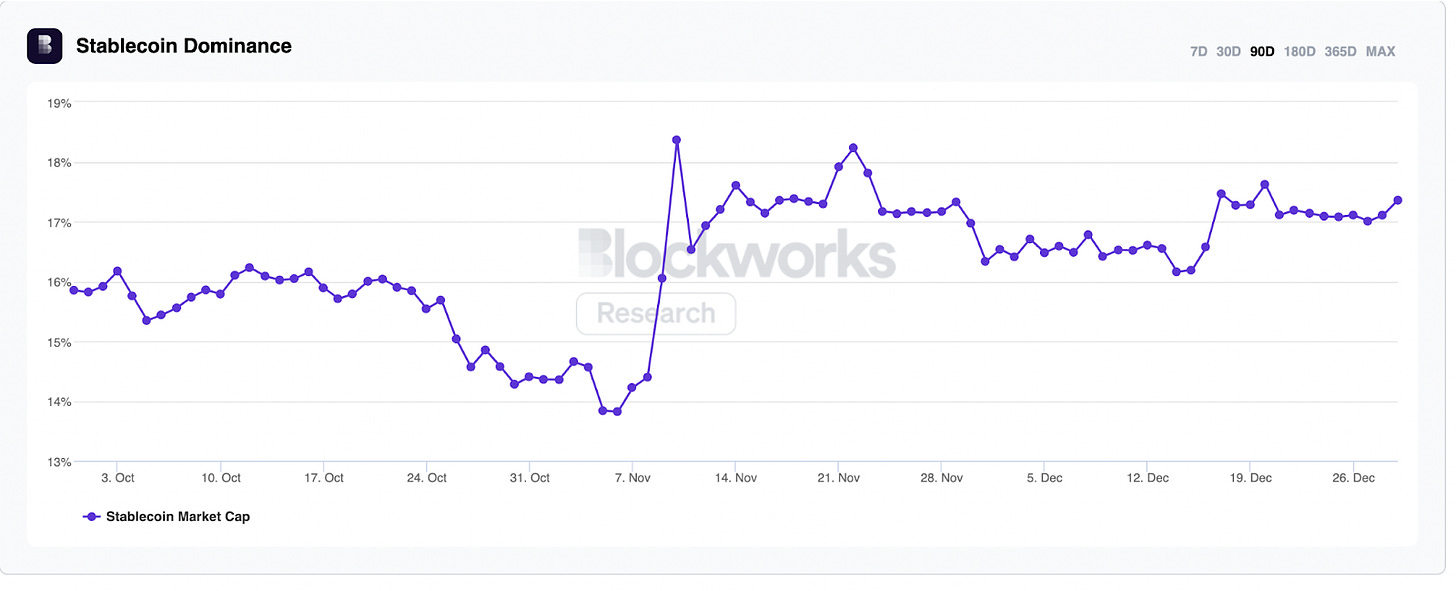

Stablecoins will likely get a renewed spotlight moving forward. 2022 has been brutal for the stablecoin market due to the UST depeg. Near’s USN and Tron’s USDD both depegged and the former was completely scrapped.

However, as the chart above shows, there has been a spike in stablecoin demand in the first week of November. So, despite all the FUD, there is still a need for stablecoins.

The two most exciting upcoming stablecoin implementations are Curve’s crvUSD and Cardano’s Djed.

Curve is a popular DeFi app that specializes in stablecoin swaps. Their native crypto-collaterized crvUSD will likely play a major role in their liquidity pools. Plus, Cardano is actively working on the Djed algorithmic stablecoin. Djed will play a big role in Cardano’s DeFi ecosystem.

DeFi revival?

Following the FTX debacle, DeFi apps like Uniswap have experienced increased activity. In mid-November, Wu Blockchain tweeted the following:

“Due to the loss of trust in CEX, the trading volume of Uniswap increased, V3 and V2 burned more than 2300 ETH in 7d, which has caused ETH to fall into deflation. MEV robotics activity has recently peaked. The number of addresses trading USDC in DEXs also hit a new high.”

As DEX utility increases, their native governance tokens may become more valuable in 2023.

Andre Cronje is back

DeFi savant Andre Cronje is back working on Fantom projects. Andre Cronje was responsible for creating protocols like Yearn Finance. He since started working as a DeFi architect for Fantom before taking a break from work citing burnout. He has since returned from his self-imposed exile and outlined the 2023 plans from Fantom. These include:

Gas monetization to allow revshare for dapps based on has used.

Gas subsidies: Interact with wallets without the wallet needing to pay for gas fees.

Funding scheme: This will target dapp devs that could use a funding boost for their projects.

With Cronje back, things looks green for Fantom. FTM already spiked significantly as a result of this optimism.

NFT Overview

Ethereum also remained the most popular NFT chain in December. While Solana has previously held the number 2 spot, you can see that Polygon has tried its best to take over the runners-up crown this month.

How about NFT marketplaces?

It looks like OpenSea’s market dominance has gone up considerably over the month. Over the last 30 days, the top 5 most popular NFTs by volume are:

It’s worth noting that former US president Donald Trump’s NFT collection has already become the 5th most popular collection over the last 30 days, despite launching in mid-December.

Solana NFTs transitioning to Ethereum?

NFT firm Dust Labs announced that they are migrating their two top-performing Solana NFT projects — DeGods and y00ts — onto Ethereum and Polygon, respectively. They are doing this to increase NFT utility. However, this may potentially hurt Solana's utility in the long run.

NFT Alpha

Meta NFT Marketpace

Following Reddit’s trail, Meta announced that they would be launching their own NFT marketplace using Polygon’s technology. Meta will allow creators to mint and sell NFTs but won’t be charging any gas fees. It will be interesting to see how this pans out for NFT traders.

ApeCoin staking

Apecoin’s staking program has started. If you own a Yuga NFT, this could be a cool way to earn passive income. More details on the staking program will be provided later.

Is DCG insolvent?

Popular crypto lender Genesis is working with restructuring lawyers to prevent insolvency. Genesis’s parent company – the Digital Currency Group [DCG] – is looking to raise capital to mitigate bankruptcy. As per reports, the raised funds will be used to pay off a $600 million loan taken from a group of investors, which include the Todd Boehly-led Eldridge Industries. As per FT, DCG has $1.6 billion in debts due to Genesis.

Theta Launches Metachain

After launching the testnet in October 2022, Theta Network released its new mainnet on December 1, 2022. This is the fourth upgrade to the Theta mainnet and introduces metachains – an interconnected network of subchains. As per Theta, the main mission of the chain is “to meet the needs of video platforms, ticketing companies, metaverses, and many other enterprises as they evolve to decentralized models.”

The metachain structure includes:

1 main chain.

Unlimited subchains. Each web3 business can have their own highly customizable subchain.

This metachain format should potentially improve Theta Network’s scalability.

ApeCoin and Chainlink Staking Launch

Both Apecoin (APE) and Chainlink (LINK) launched their staking programs in December.

ApeCoin staking

5th December 2022 - The staking site, ApeStake.io, went live.

5th-7th December 2022 - The $APE contract was funded.

12th December 2022 - The first staking rewards were accrued.

Chainlink staking

The beta version of Chainlink Staking v0.1 launched on December 6 at 12 PM ET for Early Access. Two days later, on December 8, 2022, at 12 PM ET, the staking program opened up to everyone with an initially limited 25M LINK pool cap. Staking v0.1 plays a significant role in allowing the network to test various parameters to collect data and learn how cryptoeconomic security could evolve to meet users' needs.

Proof-of-Reserves – Real or Scam?

Following the collapse of the FTX, centralized exchanges have started providing “proof-of-reserves” or PoR. PoR is a cryptographic proof that verifies that an institution holds sufficient reserves to back all customer balances. A third-party auditor ideally does the verification. As per Kraken founder Jesse Powell, a PoR audit must have the following elements:

Sum of client liabilities – excluding negative balances.

Variable cryptographic proof that each user’s account balance was included in the sum.

The digital signatures that prove that the custodian has control of the wallets

Over the past few weeks, PoR reports have been presented by the likes of Binance, Coinbase, Kraken, etc.

However, many people, including SEC CEO Gary Gensler, have questioned the authenticity and reliability of such reports. Gensler said

“Proof of Reserves is neither a full accounting of the assets and liability of a company, nor does it satisfy segregation of customer funds under the securities law…There are some in this field that have talked about ways to give customers confidence that their crypto is really there. They should do that by coming into compliance with time-tested custody, segregation of customer funds rules and accounting rules.”

Many on Twitter had also observed that a snapshot PoR has no value since it just says, “we had the money when the snapshot was taken.” A continuous PoR should be the way to go.

Polygon Launches Second zkEVM Testnet

Ethereum scaling solution Polygon announced the launch of its second public testnet, calling it the final step before the launch of its mainnet. The new testnet will include a new upgrade christened recursion, which the protocol claims could result in a notable increase in scalability. However, Polygon has yet to disclose when the actual mainnet launch will occur.

Polygon has claimed it is the first zkEVM to reach the public testnet phase with an open-source code for its proving system, which is a critical component of running the zkEVM. However, Polygon’s claims of being open-source have received some flak from other zkEVM platforms for its use of the term.

zkEVMs are an Ethereum scaling solution that has gained considerable traction over the past year. While not yet proven, they could potentially vastly improve Ethereum’s speed and transaction costs and enable on-chain privacy while helping developers to build applications more efficiently. This could eventually create an avenue for a host of on-chain applications and bridge the gap between off-chain data and real-world assets into crypto.

Visa To Allow Ethereum Holders To Set Up Auto Payments

Visa, the global credit card giant, has been dabbling with smart contracts and programmable payments. Now, the company has proposed allowing Ethereum holders to set up programmable payments from their wallets, eliminating banks and other third parties from transactions. While regular bank accounts enable the easy setting up of automatic payments, ultimately, the banks control the system and funds. So despite the recent market downturn, Visa is venturing into what it believes will be the future of payments.

The proposal by Visa was co-authored by Visa’s head of central bank digital currencies and protocols, Catherine Gu. The proposal utilizes a concept called Account Abstraction. Ethereum accounts consist of externally owned accounts called user accounts or smart contract accounts. Visa is proposing using account abstraction to combine both into one Ethereum account type and give smart contract functionality to Ethereum user accounts.

Account abstraction offers several advantages, such as enabling multi-owner accounts through multi-signature verification and delegable accounts. It also allows public accounts from which any user can transact. According to Visa, account abstraction will allow for programmable validity for verifying and validating blockchain transactions. However, account abstraction is yet to be implemented on Ethereum. Visa is already working with Ethereum developers as it looks to increase the capacity to process large transactions and provide better security and interoperability.

Ren Users Risk Losing Millions As Protocol Shuts Down

Alameda Research-backed Ren Protocol has urged users to withdraw their funds or risk them being lost forever, setting off a furious reaction within the community. Ren had announced on Twitter, reminding users that their assets on Ren 1.0 need to be bridged back to their respective chains, with the original network set to shut down thanks to the events unfolding at Alameda Research. The protocol stated that the bridging was necessary because compatibility between Ren 1.0 and 2.0 cannot be guaranteed. The development team believed shutting down Ren 1.0 was the best course of action.

Data from DeFiLlama shows that Ren has over $35 million in Total Value Locked, with over $31 million on Ethereum. The community has been highly critical of Ren, comparing the situation to a “Rug Pull.” Some users have raised doubts about blockchain technology in general, while others have cast doubt on the decentralization of the Ren Protocol, with the development team making such drastic decisions.

Binance.US To Acquire Voyager Digital’s Assets

Binance.US has announced that it has reached an agreement to acquire bankrupt crypto lender Voyager Digital’s assets. According to an official blog post, the agreement clears the path forward for customer funds of the crypto lender to be unlocked at the earliest and returned to them as crypto previously held in Voyager accounts. Binance.US staved off competition from other bidders such as Wave Financial, CrossTower, and INX. Additionally, Binance.US has agreed to make a $10 million deposit in good faith and reimburse Voyager Digital up to $15 million for specific expenses.

The announcement of the acquisition comes at a time of significant turmoil in the crypto industry, with the collapse of FTX putting centralized cryptocurrency exchanges under additional scrutiny. Voyager Digital had filed for bankruptcy after it was discovered that it had an exposure of $650 million to the collapsed crypto hedge fund Three Arrows Capital (3AC).

Is SBF Entering a Plea Deal?

According to reports, FTX founder Sam Bankman-Fried is reportedly expected to enter a plea over his involvement in the demise of the FTX exchange. The FTX collapse saw millions defrauded from investors and billions in customer funds lost, sending shockwaves through an already teetering industry. Court records have shown that Bankman-Fried will be arraigned on the 3rd of January 2023 before US District Judge Lewis Kaplan at the Manhattan Federal Court.

Bankman-Fried is facing a litany of charges brought in by prosecutors, who have accused him of engaging in a “fraud of epic proportions.” The FTX founder is accused of redirecting customer deposits to crypto hedge fund Alameda Research, purchasing real estate, and making political donations. He has been charged with two counts of wire fraud and six counts of conspiracy, which include money laundering and campaign finance violations, charges which could see him spend decades behind bars.

Bankman-Fried’s associates, Caroline Ellison, the CEO of Alameda Research, and Gary Wang, co-founder of FTX, have already pleaded guilty to defrauding investors, have agreed to cooperate with authorities, and have also paid hefty fines. It is speculated that a similar deal awaits Bankman-Fried, but authorities have so far not provided any details on their course of action.

Looking Forward: The three biggest opportunities in 2023

To close our report, let’s end with the three biggest crypto opportunities that Ethereum co-founder Vitalik Buterin has recognized for 2023.

#1 Digital wallets

“If you can make a wallet that a billion people will use, that’s a huge opportunity.”

An easy-to-use wallet that can seamlessly onboard billions of users can be very beneficial.

#2 Stablecoins

Stablecoins have taken a beating this past year, mainly due to Terra’s collapse. Developers should focus on creating an inflation-resistant stablecoin.

“If you can make a stablecoin that can actually survive anything up to, and including, a U.S. dollar hyperinflation, that’s a huge opportunity as well if you can create something that will feel like a lifeline for everyone going through that situation.”

#3 Blockchain level-up

Finally, Buterin believes that blockchains need to evolve to compete with big tech.

“If you can get signed in with Ethereum to work and if you can unseat Facebook and Google and Twitter as the login overlords of the internet, that itself is a huge opportunity, right?”

If by any chance you were a victim of mining or investment scheme that required you to send your personal asset, money or cryptocurrency in any form to a third party then you obviously need some light in this dark tunnel. I have been a crypto holder since 2014 and was a victim of the Quadriga scheme in 2016. All the red flag right there but it was too late. Luckily I found an article where I was able to report and reclaim my lost asset, Now take a look at this article where you can Report and reclaim your crypto loss via easyreclaimer@ gmailcomyou'd find all your missing pieces

In an era dominated by technology, the internet has become an integral part of our daily lives. While it has opened up new avenues for communication, learning, and entertainment, it has also given rise to a darker side — online scams. Older adults, in particular, are often targeted by those seeking to exploit their trust and lack of familiarity with the digital landscape. In fact, folks over the age of 60 lost an estimated $3.1 billion in 2022, I was a victim too but I was able to get help from my FBI friend who connected me with easyreclaim0 @ Gmail com