2022 has been an interesting year, to say the least. While crypto is still reeling from a bear market, we have seen several developments in crypto sanctions and adoption. In this report, let’s go through the crypto market and its many verticals.

Crypto Market Overview

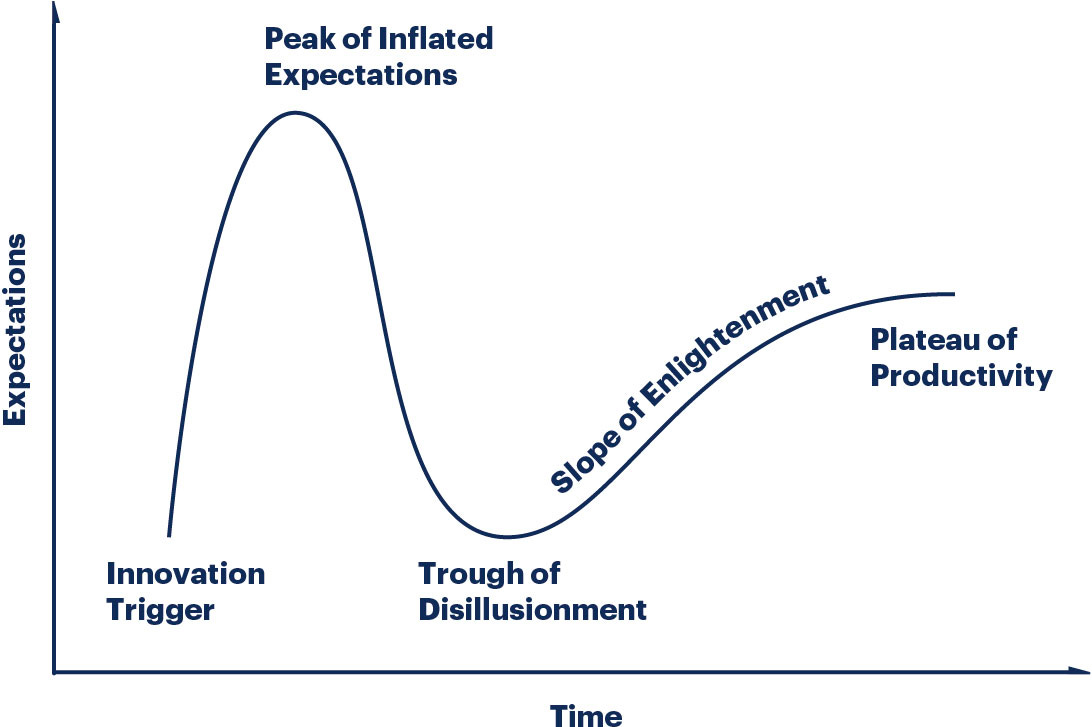

After BTC and ETH reached their all-time highs in 2021, the crypto market went through a relative lull in 2022. As a result, the hype surrounding crypto and blockchain has definitely gone down. The graph below shows Gartner’s hype cycle.

We can say that around 2020, crypto reached the “peak of inflated expectations.” Right now, we can say that we have either reached the trough of disillusionment or are on our way there. This is not necessarily a bad thing. We can only expect true innovation when there aren’t any inflated expectations.

However, 2022 saw historical strides being taken when it came to crypto adoption. Two countries – El Salvador and the Central African Republic – have officially made Bitcoin legal tender. Not only does this allow the two countries to participate in the global Bitcoin economy. But, it also empowers the local government to take control of their respective economies and create value for their people. Having said that, it is essential to point out that El Salvador has faced considerable losses on its BTC investments due to the bear market.

Bitcoin stats

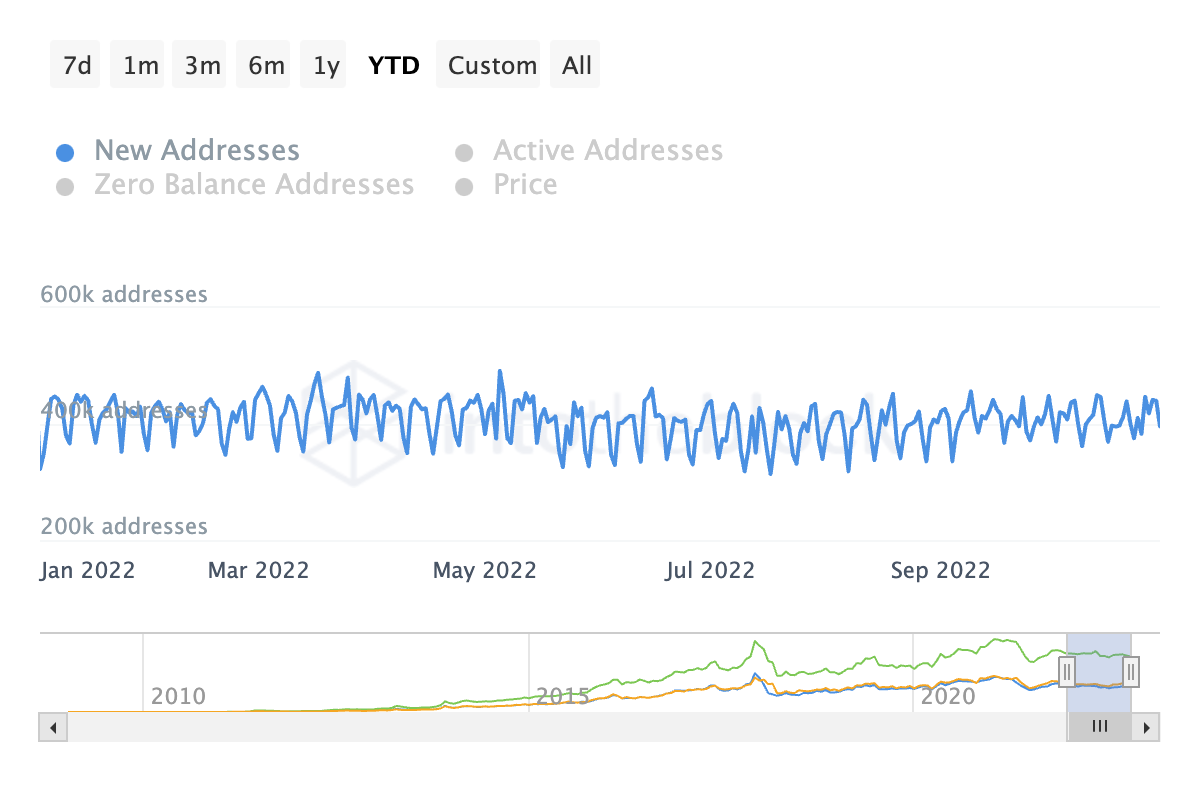

The number of new addresses entering Bitcoin has remained relatively consistent between 350,00 and 450,000.

This positive sign shows that people are still interested in BTC despite market conditions. Here is another thing to consider.

Despite bearish conditions, Bitcoin hash rate and difficulty have both reached new heights. However, with the market going down, the miners inevitably had to sell their coins to stay in business.

As per the “Miner Reserves” chart, you can see that the miners have repeatedly sold their BTC reserves on staying in business.

DeFi Market Overview

The DeFi market has taken a proper beating in 2022. First, let’s look at the numbers. The total value locked (TVL) in various protocols has crashed from $167 billion to $55.15 billion. Currently, 14 protocols have TVL above $1 billion, with MakerDAO, Lido, and Curve leading the pack.

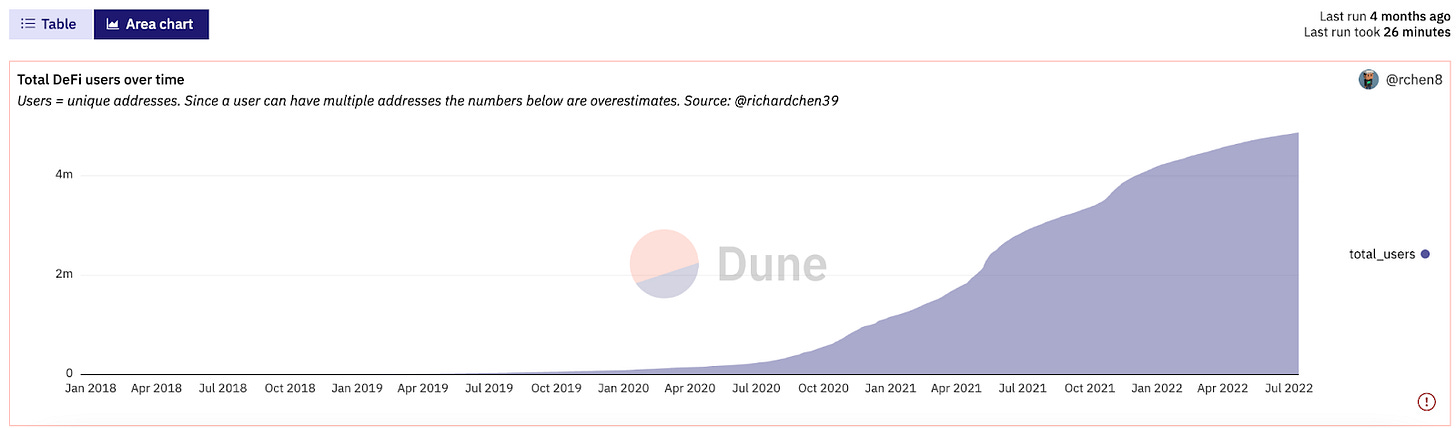

Ethereum currently has the richest DeFi ecosystem with $32 billion TVL. BNB chain and Tron come a distant second and third with $5.82b and $5.24b. Overall, a little over 650,000 new addresses have entered DeFi so far this year. Last year, in this same time frame, over 2 billion new addresses entered DeFi.

DeFi got severely affected by the crypto contagion and the Terra disaster. To give a quick overview:

Terra’s UST lost its dollar peg due to a series of liquidations.

This triggered a series of disasters wherein multiple companies got bankrupt.

Celsius, Voyager, and 3AC – every single company that had significant exposure to DeFi and/or Terra got bankrupt.

This entire catastrophe devastated the crypto market, but it was particularly hard on DeFi. The Terra incident happened on May 9. 2022. The TVL slumped from $129.23 billion to ~$78 billion within a month! That’s a near $50 billion drop in valuation!

DeFi and Sanctions

In 2022, we also saw the implications of sanctions on DeFi. The US Treasury Department's Office of Foreign Assets Control (OFAC) decided to ban Tornado Cash. The OFAC claimed that money launderers widely used Tornado Cash. Furthermore, state-sponsored North Korean hackers allegedly cleaned their hacked money using the protocol. As a result, DeFi apps like Aave, Uniswap, Balancer, and dYdX have promptly banned users directly or indirectly from interacting with Tornado Cash.

This raised several questions. Isn't DeFi supposed to be open and permissionless? It clearly isn't in this current iteration. However, regulatory compliance could be necessary for DeFi to grow.

DEX Analysis

As per Dune Analytics, most of the trading volume was conducted on Uniswap. Following that, we have DODO (8.6%) and Curve (7.9%).

Let’s stick with Uniswap.

When it comes to total users over time, Uniswap remains the undisputed king. Total users on the platform crossed 4 million in 2022.

Monthly DeFi Revenue

As you can see, DeFi revenue generated per month has gone down significantly over 2022. Uniswap and Aave generated the most revenue in 2022.

Revenue Generated Over The Past Week

Protocol

7-day Average Fees

Uniswap

$3,318,052.28

Curve

$365,238.90

SushiSwap

$274,281.21

Aave

$266,583.38

Balancer

$111,705.25

DeFi Alpha To Watch Out For

The Curve stablecoin is going to launch soon. The stablecoin will be a crypto-collateralized coin. Curve Finance is well-known for being a stablecoin swapper and has immense liquidity.

There are rumors that DeFi savant Andre Cronje might be back working on Fantom projects. If that's the case, then keep an eye out on Fantom’s DeFi ecosystem.

NFT Market Overview

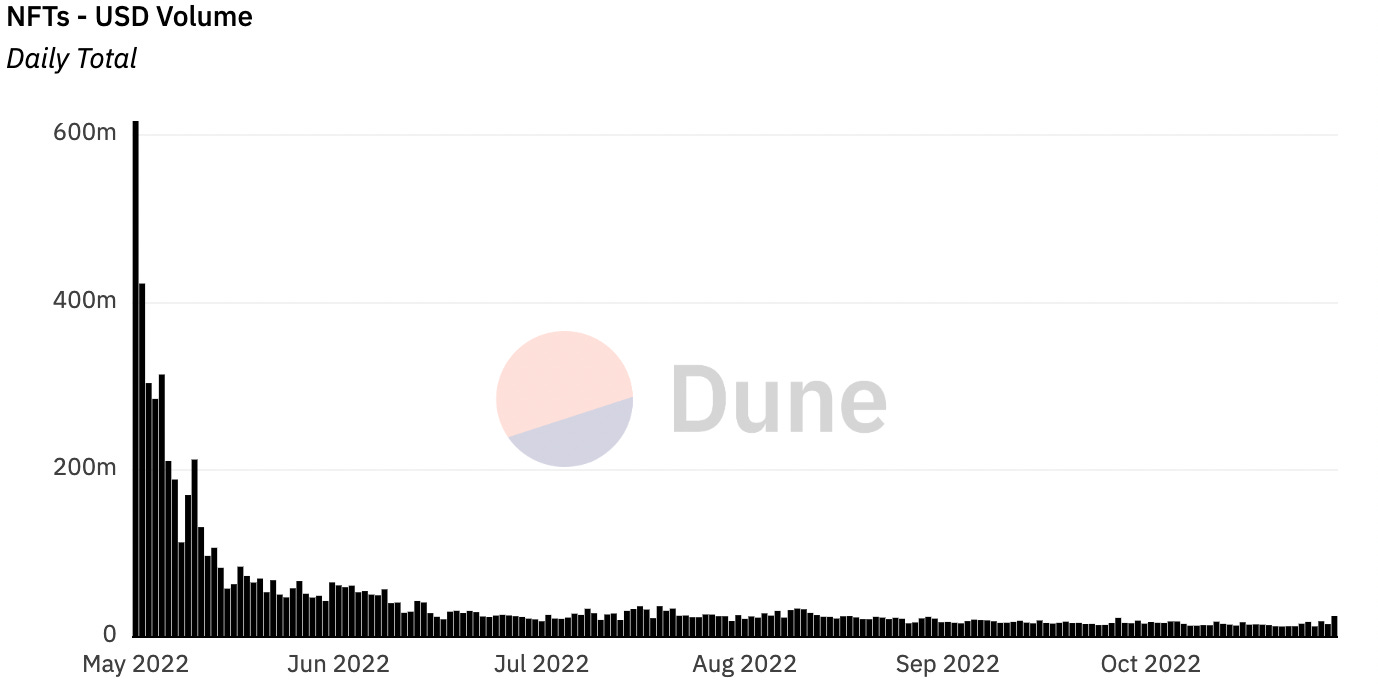

NFT trading volume has also taken a severe beating.

In May 2022, the daily NFT trading volume on major platforms was around $600 million. Since then, it has dropped to below $30 million per day. This drop in NFT demand was understandable due to the market conditions.

The total number of wallets that ever owned an NFT crossed 4 million, 5 million, and 6 million in 2022.

Comparing the NFT marketplaces

Let’s compare the top NFT marketplaces: OpenSea, NFTX, LarvaLabs, LooksRare, SuperRar, Rarible, and Foundation. Let’s compare these platforms via monthly trading volume and total monthly transactions count.

Monthly trading volume

Regarding monthly trading volume, LooksRare dominated the numbers at the beginning of 2022, following their much-hyped launch. After that, however, OpenSea took over the throne for the rest of the month. Also, note how monthly trading volume plummeted from over $17 billion to less than half a billion dollars.

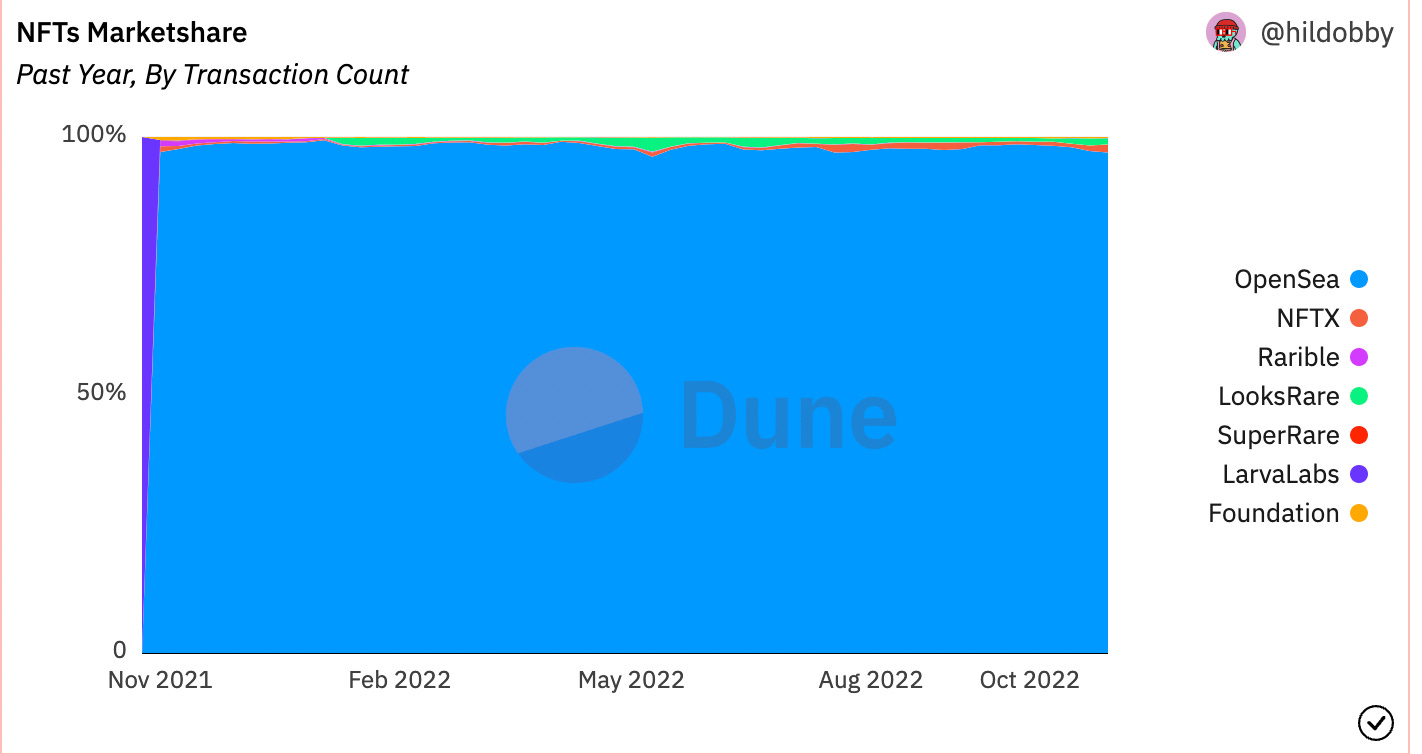

Monthly transaction count

When it comes to the sheer quantity of NFT transactions, nothing comes close to OpenSea.

Speaking of OpenSea, here are the top 5 NFT collections by volume.

Looks like CryptoPunks and BAYC remain the big dogs.

NFT Alpha To Watch Out For

Reddit NFTs have already become extremely popular.

Meta announced that they will be launching their own NFT marketplace using Polygon’s technology.

“Art Gobblers” has defied the bear market and achieved impressive trading volume.

More Alpha To Check

Outside of DeFi and NFT protocols, here is some more alpha for you to check out in crypto.

With the World Cup coming up, fan tokens and CHZ could become very hot. Also, Algorand (ALGO) is a partner of the Fifa World Cup.

Elon Musk took over Twitter. There is a lot of speculation that he could integrate Dogecoin into the protocol. DOGE rose by ~100% since Musk took over.

Matter Labs’ zkSync is launching a “Baby Alpha” V2. Apparently, this is the first “product-ready rollup with ZK-powered EVM.

UPDATE: The FTX Debacle

It is impossible to talk about the crypto market situation without shedding light on the whole FTX debacle. In short, one of the biggest crypto exchanges in the world went spectacularly bust due to solvency issues. Further investigations revealed that FTX had misappropriated user funds.

FTX was founded by Sam Bankman-Fried (SBF), who, till recently, was considered the golden child of crypto. During the 2020 bull run, FTX was everywhere. They went big with sports sponsorships – Miami Heat, Tom Brady, Mercedes Formula 1, ICC cricket world cup, etc.

There are two things to keep in mind before we go any further:

FTT is the native token of FTX.

SBF had another company called Alameda Research – a quantitative crypto trading firm.

Investigating the FTX debacle

Coindesk published a report on November 2, revealing that most of Alameda Research's collateral was in FTT tokens.

This raised major red flags. How can a company own the native token of its sister company as the lion's share of its collateral?

Binance CEO Changpeng "CZ" Zhao announced that he would start selling off the FTT tokens currently held by the exchange. Naturally, this caused widespread panic, and everyone started dumping FTT.

As the dump got worse, FTX started running out of funds. Eventually, they were forced to pause withdrawals.

SBF reached out to CZ for a potential acquisition. Binance initially agreed but backed out after discovering a ~$10 billion hole in the balance sheet.

Further investigations revealed that FTX misused user funds to make risky trades via Alameda Research.

The backlash has been severe and predictable. Several regulatory bodies in the Bahamas (where FTX was operating from) and the US have opened their investigations.

Institutes like Sequoia Capital, BlockFi, Galois Capital, Ikigai Fund, and Multicoin had a significant amount of capital tied up in FTX and suffered massive losses.

The current situation

The FTX situation is still ongoing. As of writing, more institutes are revealing their exposure to the exchange. We still don’t know how bad the FTX contagion will be. Regardless, the lesson here is clear – don’t keep your coins in an exchange. Not your keys, not your coins.

Conclusion – Bears drown crypto. But we are still early

It is no surprise that 2022 has been hard on crypto. Looking at the global macro overview, we are currently going through the following:

A pandemic-ravaged economy.

The Russia-Ukraine war.

An energy crisis in Europe.

As such, it isn’t surprising that the global markets, including crypto, have been down this year.

However, before you start writing crypto’s obituary, look at this chart.

The rate of crypto adoption is keeping pace with internet adoption over the same time range. If this trend holds, there will be 1 billion crypto users by 2026/27. That’s an estimated 5X increase!

So, yes, the market has taken a beating in 2022, but we are still so early.